‘Multinational corporations bear too small share of tax burden’- Unions and CSOs tell Tanzania parliament

Nov 15, 2021

- Read this in:

- en

PSI together with Actionaid Tanzania and other CSOs presented on 12 November a tax proposals to the constitutional and legal affairs committee of the parliament of Tanzania. This is in the framework of the Tax Justice for Quality Public Services project that PSI is implementing in collaboration with FES, and is part of a campaign that aims to contribute to sealing the gaps to illicit financial flows, tax evasion and avoidance, and eliminate ‘wasteful’ tax incentives.

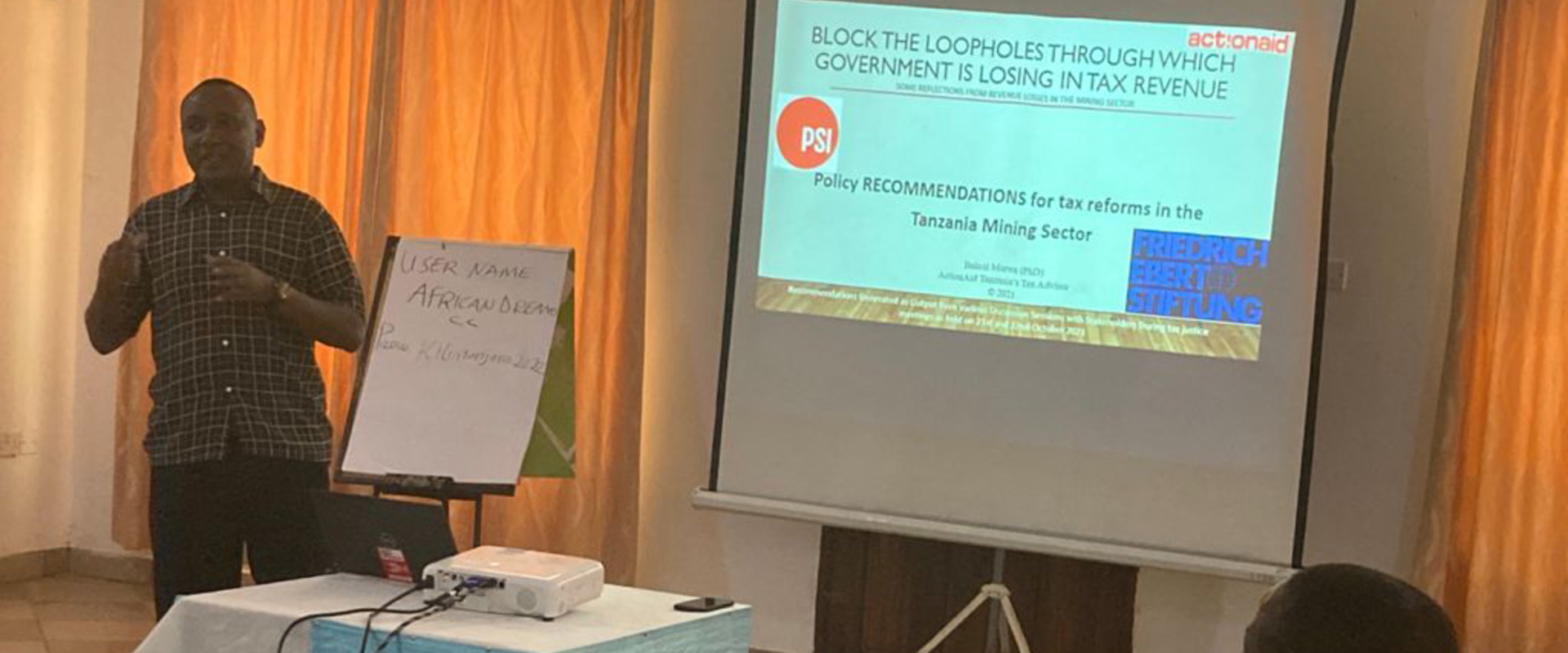

Representatives of affiliates of the Public Services International (PSI) in Tanzania; Policy Forum which is an influential civil society network in Tanzania; and Actionaid Tanzania, met parliamentarians of the Constitutional and Legal Affairs Committee of the Parliament of the Republic of Tanzania to submit a tax policy proposal titled, ‘Block the loopholes through which Government is losing tax revenue’.

The delegation led by Dr. Balozi Morwa, Tax Adviser of Actionaid Tanzania, and supported by Friedrich-Ebert-Stiftung Tanzania handed over its list of recommendations that are the output of ground-breaking research conducted by Actionaid Tanzania in 2021, “Sealing the Gap-an analysis of the revenue foregone within the Tanzania tax system and how it could be used to fund public education”, as well as PSI-FES research in 2019, “Funding Public Services-Not Foreign Profits: Re-thinking Mining Tax Incentives”. The research had been followed by a series of public dialogue events since 2019 – with the latest engagement in Dodoma on 21st and 22nd of October 2021.

The objective of the campaign is to contribute to the efforts by the government of Tanzania in detecting tax-motivated illicit financial flows like tax avoidance or evasion and loss of revenue from tax incentives.

Tanzania losses an estimated TShs 1.1 trillion (US$531.5million) per year due to tax revenue foregone through corporate VAT exemptions and Special Economic Zones. It is equally losing USD 1.83 billion from tax incentives, capital flights, failure to tax informal sector and other forms of tax evasion. At least USD 265 million loss in the mining sector due to excessive low royalty rates, tax incentives and tax evasion.

This amount would ensure adequate textbooks, classrooms, and education materials for public schools in Tanzania. It would also improve public health delivery in Tanzania. In the last four years, wages of public sector workers in Tanzania have not seen any upward review. Foregone revenue could have ensured wages of public sector workers increase.

The recommendations want the Tanzanian government to scrap wasteful tax incentives granted to extractive industries by ensuring that all current tax incentives – including discretionary tax incentives and those applicable to special economic zones – be reviewed to assess whether they are fit for purpose. This would include undertaking a cost-benefit analysis and public scrutiny including by parliament, media, civil society, and citizens. Tax incentives are not justified when there is no benefit to the Tanzanian society as a whole.

The review should also include publishing an annual overview of the costs of tax incentives as part of the annual budget, so that the impact of corporate tax incentives is transparent.

Another recommendation is to put in place a Tax Incentives Management and Transparency Act to enable the government to monitor, review, and analyze the economic impact of tax incentives.

Not least, the government must allow for meaningful participation in mining contract-making processes by giving people (through their representatives in the national assembly) adequate time to review and present their views on a contract approval that will impact their lives so enormously.